Filing taxes in Pakistan might seem might be difficult or tough task, but it’s important and has its own perks. Whether you’re a filer or starting from scratch, this guide will walk you through the process of how to become tax filer in Pakistan. Hence, therefore let’s explore the benefits of filer in Pakistan.

Why is it Important to be a Filer? Here’s What You Need to Know

- It’s the Law ‘A Legal Obligation’: As a citizen of the country, paying taxes isn’t just a legal requirement it’s a way to contribute to your country’s economy.

- Access to Benefits ‘Get Good Stuff’: Filers can benefit from reduced lower taxes on things like property deals and vehicle registrations.

- Avoid Nasty Surprises ‘Avoid Penalties’: If you don’t file or a tax filer, you could end up paying more in penalties and higher tax rates.

Who can Become a Tax File? Are You Eligible?

- Income Levels ‘Threshold’: Individual who are earning over a certain amount (for example, PKR 600,000 per year), need to file tax return and become a filer.

- Where You Live ‘Resident Status’: Whether you’re a resident of Pakistan or a non-resident with taxable income here, you’re required to file your tax return.

- Age Requirement ‘18 +’: If your age is 18 years or older, then you are eligible to file your taxes.

How to Become a Tax Filer in Pakistan by 2025?

Here’s a complete step-by-step guide, along with the perks of being a filer in the country.

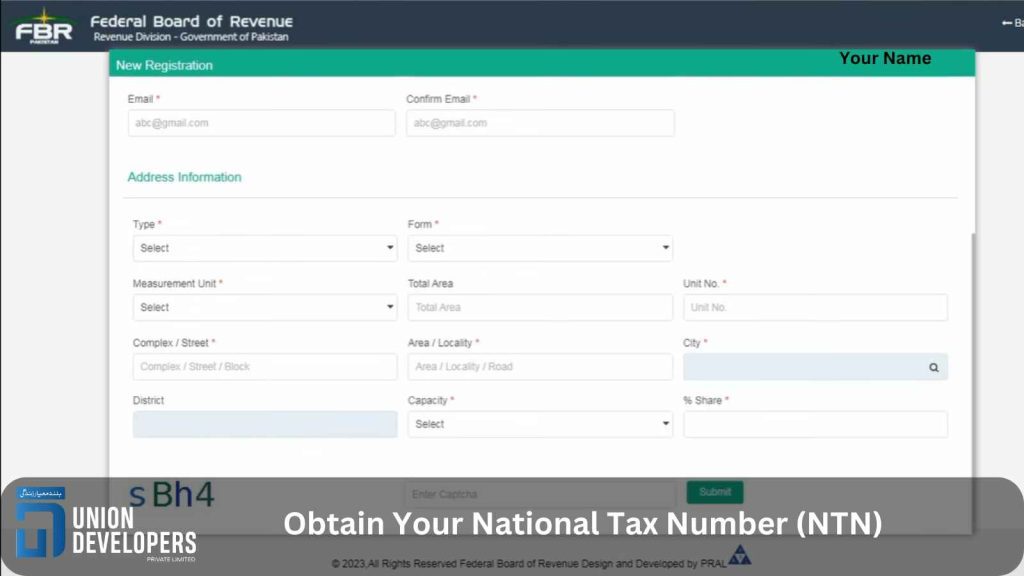

Step 1: Obtain Your National Tax Number (NTN)

- Log onto the FBR Website: Open your browser and go to the Federal Board of Revenue’s official website.

- Sign Up or Create your Account: Create an account using your CNIC (Computerized National Identity Card) number.

- Apply for NTN: Fill out the online form and receive your NTN online, right away.

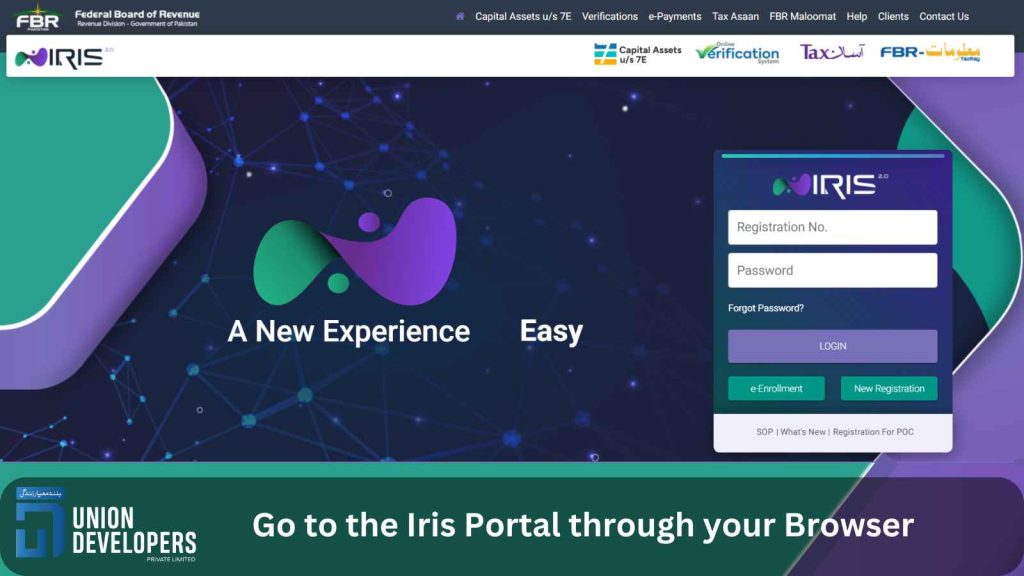

Step 2: Go to the Iris Portal through your Browser

- Access Iris: Log-on to the FBR Iris portal, use your NTN and password.

- Fill & Complete Your Profile: Add your details like address, contact information and bank details.

- Verification Process ‘Personal Information’: Make sure your email and phone number are verified for your account security. Note, don’t share personal details with anyone.

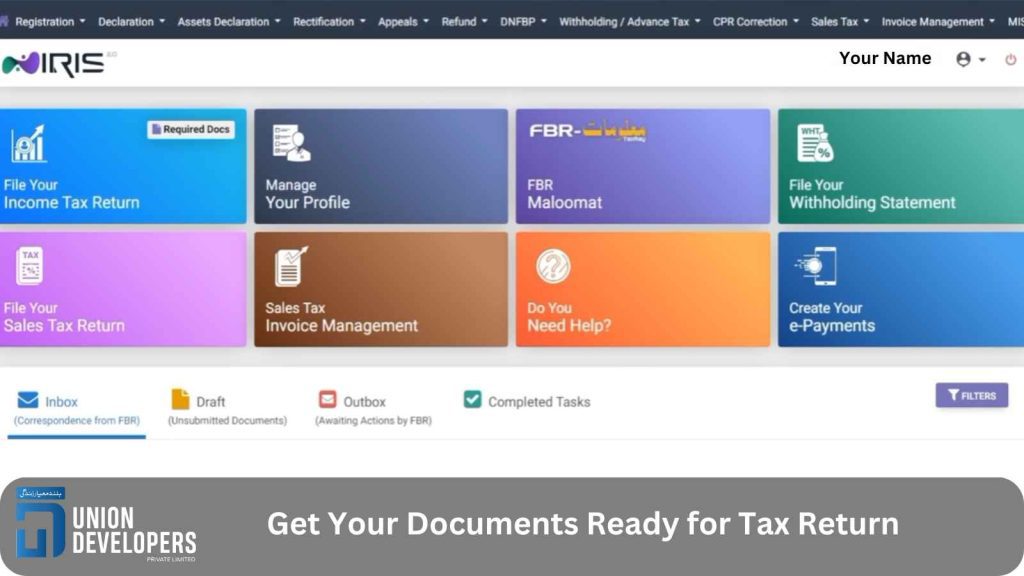

Step 3: Get Your Documents Ready for Tax Return

- Get Organized ‘Collect Your Financial documents’: Collect all relevant and important documents like salary slips, bank statements and investment records for submission and declaration of your financial assets.

- Know & Learn Your Tax Deductions: Understand and know about tax deductions and exemptions to lower your taxable income as much as possible.

- Estimate Your Taxes by Using ‘Tax Calculator’: Use online calculators to get an idea of what you will owe and get an estimated cost of your tax liability.

Step 4: File Your Tax Return

- Fill Out the Tax Return Form: Enter your income details, deductions and tax payments into the form.

- Review, Double-Check & Submit: Review everything before hitting the tab of submit.

- Acknowledge Submission ‘Save Your Receipt’: Keep the acknowledgment receipt, it’s important!

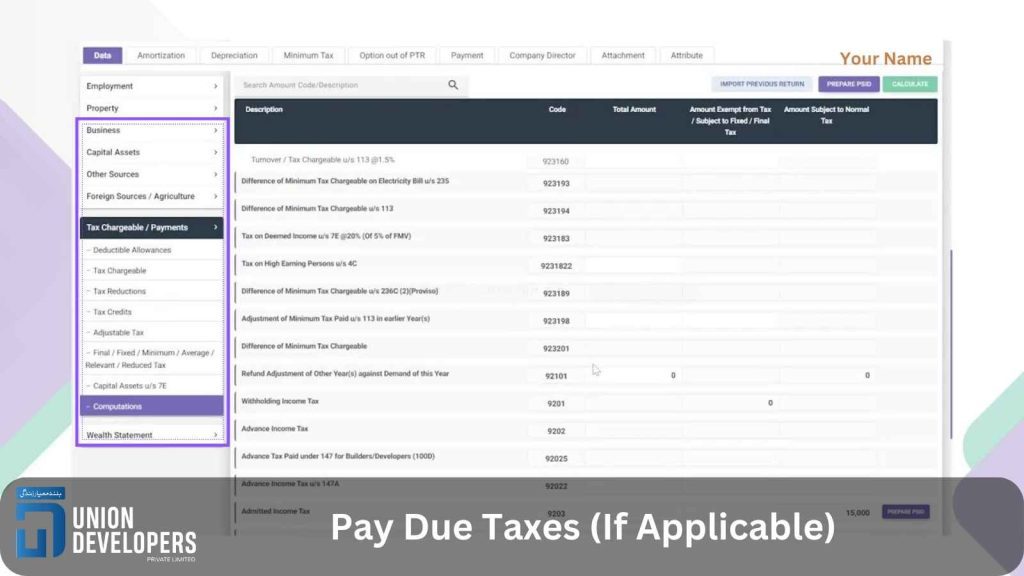

Step 5: Pay Due Taxes (If Applicable)

- Calculate What You Owe ‘Payable Taxes’: If you have to pay any taxes, calculate the amount by using the FBR system.

- Pay Online ‘On-line Transactions’: Settle your taxes online through your bank or other payment methods whichever is easier and convenient for you. Make sure to keep the record of every transaction.

- Get a Payment Receipt ‘Save as a Proof’: Save this as proof of expense including your payments of each and every transaction.

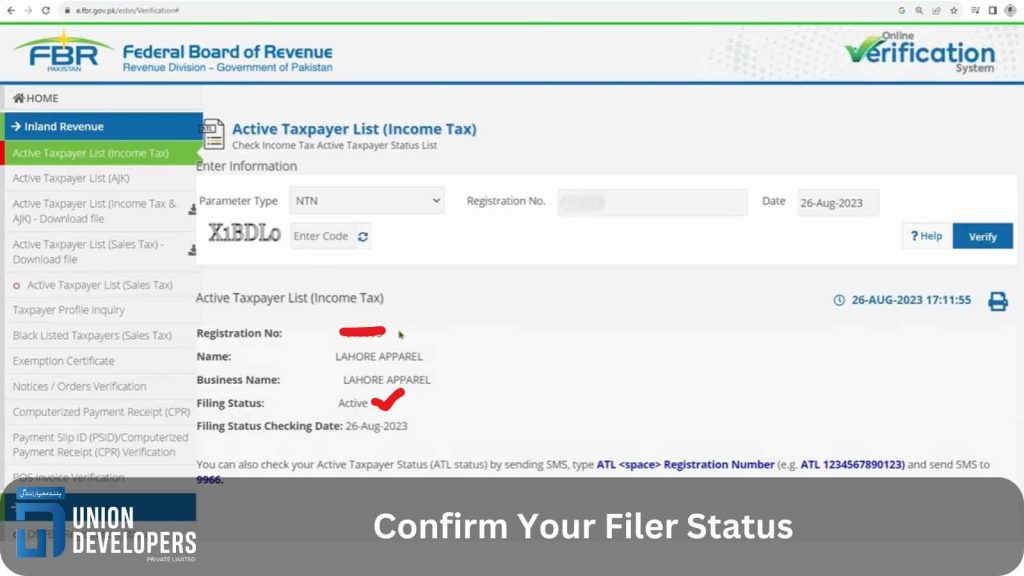

Step 6: Confirm Your Filer Status

- Check Your Status ‘As Filer’: After submitting your tax file return, see if your name appears on the Active Taxpayer List (ATL) on the FBR site or you can also check it through their SMS service by sending your CNIC Number on ‘9966’.

- Stay on the ATL ‘Updated Status’: Make sure your name is listed so you can enjoy the benefits and perks of being a filer.

Why Being a Filer is Worth It? Know the Benefits

- Lower Withholding Taxes: Filers pay less on things like bank withdrawals, property purchases and vehicle registrations.

- Easier to get Loan Approvals: Banks often prefer to lend to filers because they’re compliant.

- No Penalties & Exemptions: Filers avoid the extra charges and higher taxes that non-filers face.

Handling Common Issues ‘Challenges & Solutions’

- Tax Laws Got You Confused? Understanding tax laws can be tricky, but the FBR helpline and tax advisors can assist and help you out.

- Troubles with Iris ‘Technical Issues’? If the portal gives you trouble, contact FBR support or visit a tax facilitation center.

- Don’t Miss Deadlines ‘Timely Filing’: Keep an eye on important dates to avoid late fees.

Also Read: Difference Between Filer and Non Filer

Conclusion: Become a Responsible Citizen Today

Getting yourself registered as a Tax filer is more than just a legal obligation. Filing taxes in Pakistan is more than just a legal task, it’s a step towards being a responsible citizen and owning your responsibilities. Once, you follow this guide, you’ll get through the process smoothly and enjoy the maximum benefits of being a filer. If you need more help or any other information, consider talking to a tax professional or by visiting the FBR website.

FAQ’s, Frequently Asked Questions about Filing Taxes in Pakistan

- What is the Deadline of Filing a Tax Return?

Usually, it’s 30th July each year, but this can change. Check the FBR website to stay updated. - Can Non-Residents of Pakistan become a Filer?

Yes, if you’re a non-resident with taxable income in Pakistan, you need to file. - Made a Mistake? How to rectify errors?

No worries! You can revise your return through the Iris portal if you find any errors. - How to Check Your Status?

Just send you national identification number from your registered sim to ‘9966’, you will be notified with your current status.